Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.

There Are No Free Products

Free products aren't truly free. The costs are just not obvious.

In the summer of 2017, Albert ran out of cash. At the time, Albert had 50,000 devoted users who used the app to budget and save. But Albert was free, and we lost money every month.

Free was the status quo for new financial apps. Credit Karma pioneered the model with free credit scores. Robinhood followed with free trading. Our original plan at Albert was to follow this model. After a successful seed investment round based on this pitch, we soon realized that while Credit Karma could make money by referring users to credit cards and Robinhood could make money by taking a small cut from every trade, there was no equivalent in personal financial management.

Money management apps must give objective, impartial advice, and you can't trust a financial management tool that gets paid for every financial product it pushes.

Our initial strategy almost proved fatal.

August 11, 2017

In early August 2017, after one last unsuccessful fundraising attempt, we had one option left: ask customers to pay.

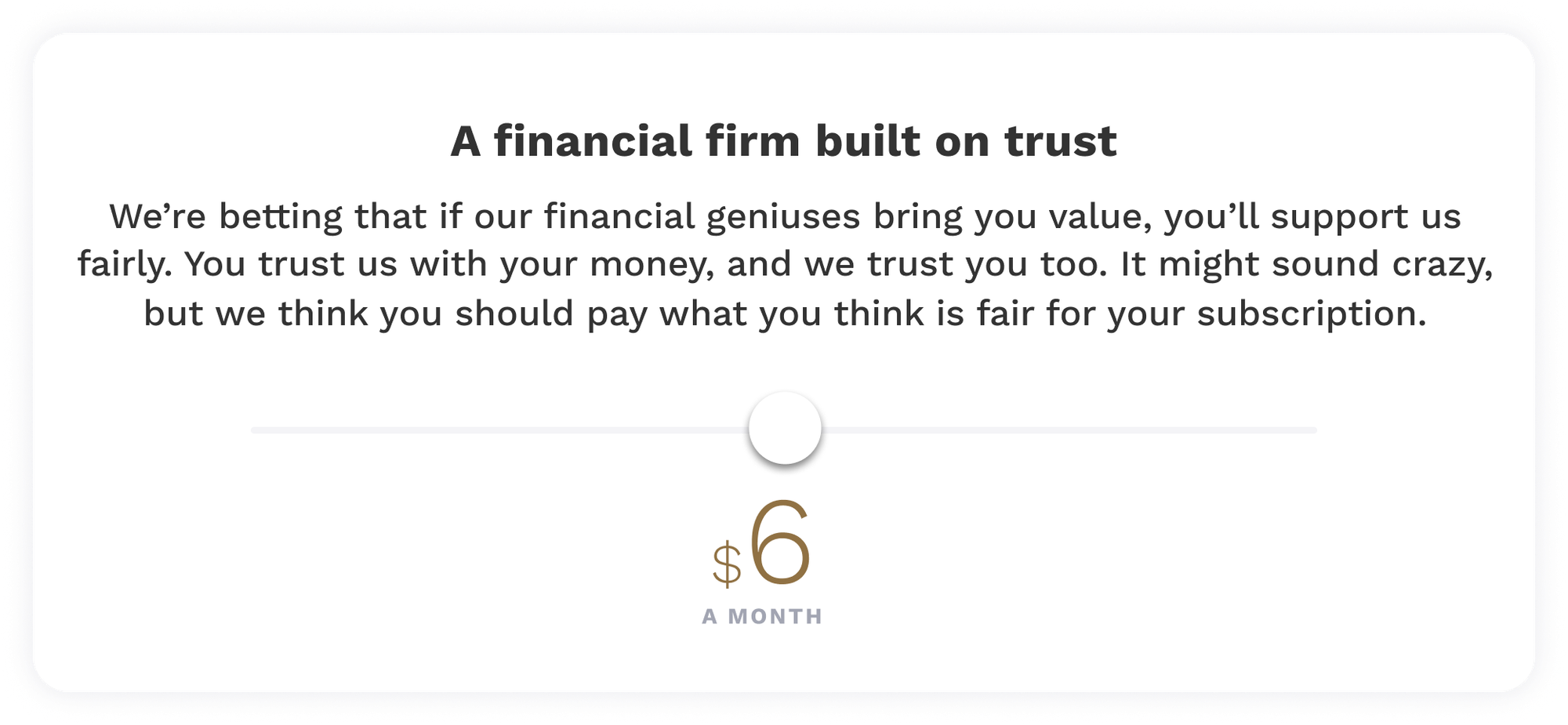

We needed to be sure that customers loved the product enough to pay for it long-term, so we asked every user to pay what they thought was fair. We showed a slider ranging from $0 to $14 a month, and the user could pick any value. Below is the original screen from the app.

Albert's original pay what's fair screen

On the morning of August 11, 2017, we launched the slider above. Over half of our users voluntarily chose to pay more than $0, averaging $4 per month. Albert went from $0 to $1 million in annual recurring revenue almost overnight.

We had almost missed the most obvious way to build a sustainable business: charging the customer. Over the ensuing five years, fintech companies mostly followed.

Below are the financial features and products that charge customers as of December 2023:

Product | Company | Monthly fee |

Automated investing | Betterment | $4/month or 0.25% of assets |

Automated investing | Stash | $3/month for basic plan; $9/month for full plan |

Automated investing | Acorns | $3/month for basic plan; $5/month for full plan |

Banking for families | Acorns | $9/month for teen banking |

Financial advice | Betterment | 0.40% of assets annually, $20k in minimum assets |

Financial advice | Fruitful | $98/month |

Identity monitoring | Lifelock | $11.99/month for basic plan; $34.99/month for mid plan. Discounts for paying annually; prices go up in year 2. |

Maintenance fee | Bank of America | $4.95/month if you keep <$500 balance |

Maintenance fee | Chase | $12/month unless you switch direct deposit to Chase or maintain $1,500/month on average |

Overdrafts | Chase | $34 per overdraft |

Overdrafts | Wells Fargo | $35 per overdraft |

Personal financial management | Copilot | $13/month, $7.92/month paid annually |

Personal financial management | YNAB | $14.99/month, $8.25/month paid annually |

Customers pay for things they use

Charging customers aligns incentives and promotes a healthy business with no hidden costs.

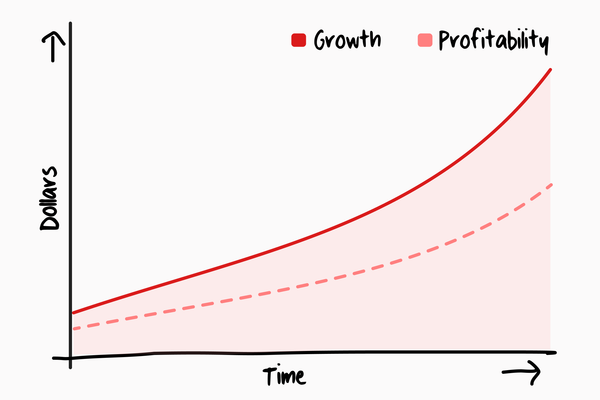

Some loud customers will tell you that your product should be free. Investors may tell you that your product should be free to promote growth. Who doesn't like free stuff?

But aside from social networks, every successful, profitable consumer product charges customers at scale. Even products initially pitched as free end up charging customers. Consider Turbotax, which touted free taxes but ultimately made it very difficult to file a tax return for free (they sold add-ons).

Look at the collection of financial products above: almost every type of money management feature charges customers. Consider health apps helping people exercise, meditate and diet: they all charge customers. News apps charge customers. Productivity apps, like to-do lists, VPN apps and email apps, charge customers. Any service that adds value charges its users.

Of course, charging customers makes sense: it costs money to service a customer, and a business must make money. An easy-to-understand fee is the clearest user experience and the simplest business model.

During ZIRP, some consumer products launched as free products or with heavily subsidized pricing. Two prominent examples were free online checking and cheap ride shares. Ultimately all products ended up with two outcomes: (i) they still lose money, or (ii) they increased pricing.

Three principles

There are three important principles to building a successful paid product:

- Bundling. Charge less for the entire service than the total cost of all individual features bought separately elsewhere. This has worked well for Albert. The bundle of Albert's products costs less than 50% of the all individual features bought separately.

- Clear pricing. Customers want to know what a service truly costs them.

- Onboarding friction. One of the most unintuitive things about charging customers is that the added friction is a good thing. When a customer makes a decision to pay for a service, even if for a free trial, they're committing to investing enough time in the service to find out if they will use it.

At Albert, we've always seen much higher retention for paying customers. Customers unwilling to pay don't invest enough time to explore the product and understand it. And then they quickly churn.

In fact, this principle is so powerful—albeit counterintuitive—that Albert's onboarding flow is over 50 screens! Millions of people have completed this flow and paid for the product. By the end of the onboarding flow, we know if we have a dedicated customer and the customer knows if they want to dedicate themselves to the product. A win for both sides.

Focus

Charging customers brings focus.

Removing "free" brings clear focus across a company. Everyone at the company knows who to serve, who to support, and who to build for. Costs are aligned with revenue, because costs only come from customers generating revenue. It's not acceptable to serve a cohort of customers that loses the company money.

Perhaps most important is the clear message to the customer: vote with your wallet. If you don't like the product enough to pay for it, you'll leave. The company knows that it must always deliver a great product, because mediocrity is punished with churn and lost revenue.

Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.