Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.

The Profitable, High Growth Startup

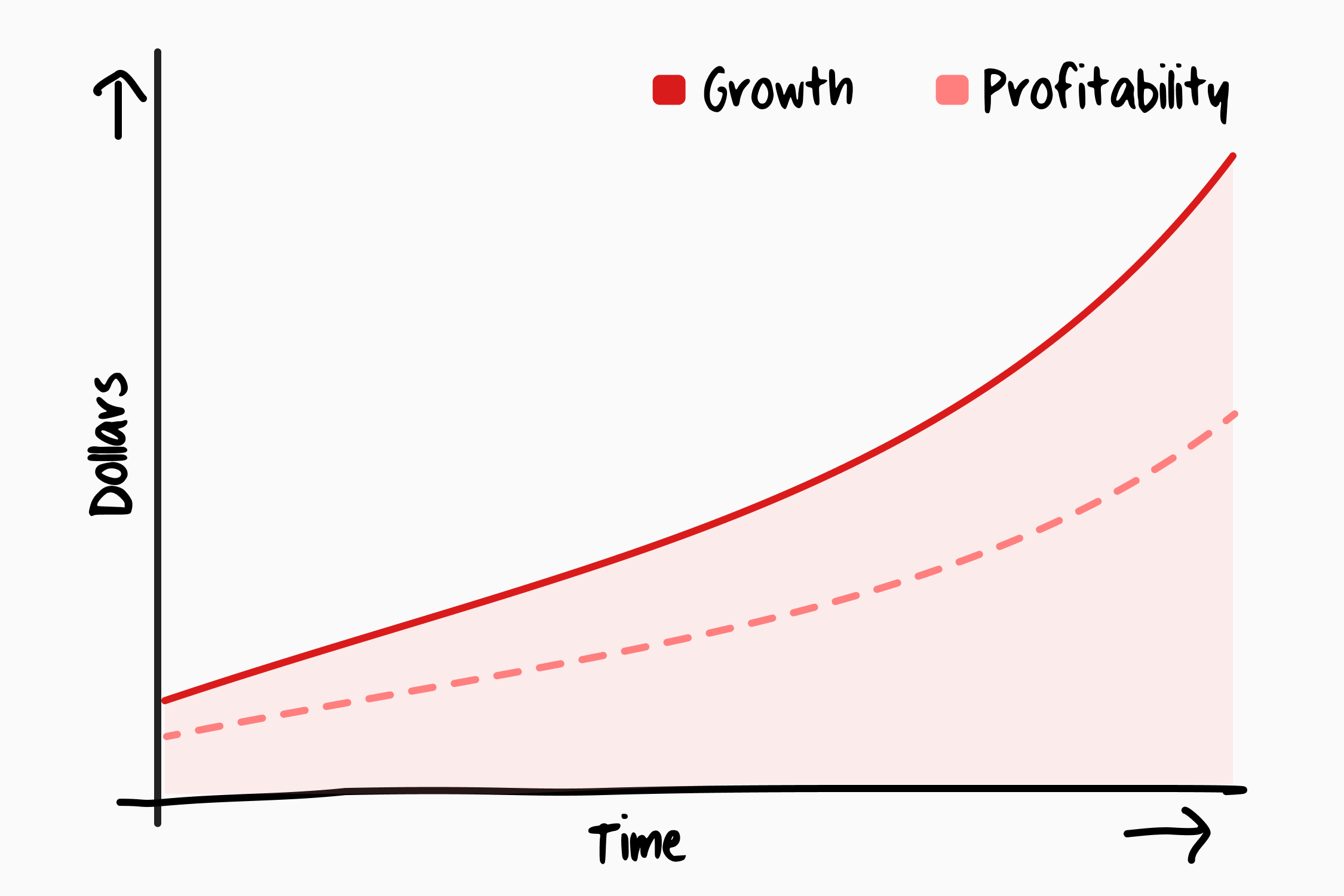

Profitability leads to operating leverage, which drives growth

In early 2022, after an unsuccessful fundraise for Albert, the financial technology company I run, I sent a letter to our leadership team: investors have lost appetite for funding losses, and we must stop burning money.

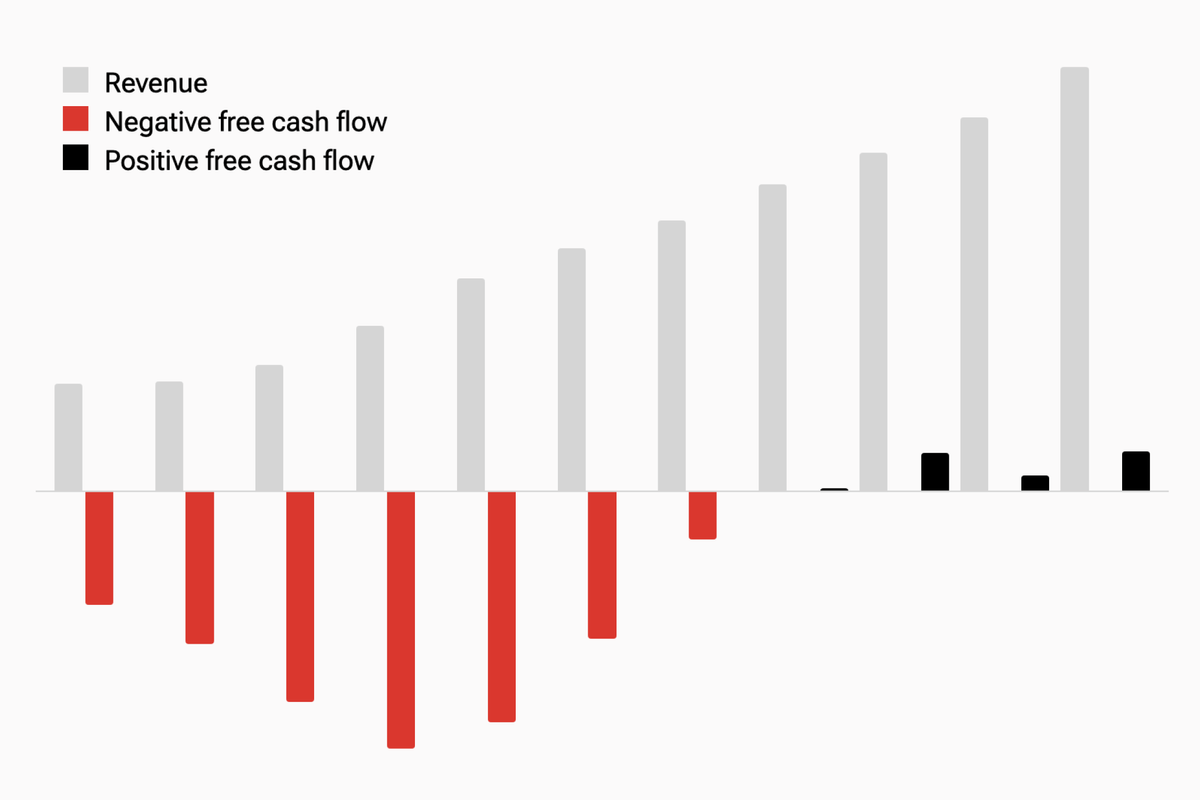

We cut variable costs, stopped new hiring, launched half a dozen new products, increased engagement and revenue per user, and focused on unit economics. Nearly four years later, Albert has been profitable for 12 consecutive quarters. We have 100 salaried employees supporting hundreds of millions of dollars of revenue.

By 2021, we had raised over $200M. Like most startups, we viewed profitability as unambitious for a startup trying to grow fast. We were wrong. We've grown faster as a profitable company than a money-losing one.

Here's the full letter I wrote to management in 2022:

To raise or to profit?

Being profitable doesn't mean you're against raising money; it means you have a choice about when to raise money.

Companies feel they face a binary choice: bootstrap and grow slowly, or raise venture capital and grow at the expense of sustainability. There is a third way: profitable, fast-growing, and able to raise money. In fact, the most effective way to raise money is to seek investors only once a company is both profitable and growing quickly.

So how do you actually drive growth while building profitably? And why doesn't everyone do it?

There are 3 key pillars to this strategy.

1. Product led growth

The growth gains from product improvements are almost always greater than the loss of growth from marketing dollars cut.

When you're burning money, the largest cost center is usually marketing. It's easy to increase spend – a button press on Meta, Google, or TikTok. But as you grow marketing spend, there are diminishing returns to every dollar spent.

When you cut marketing spend significantly, growth should crater. And it certainly would if you did nothing to offset the drop in spend. But something counterintuitive happens: spending less money forces product innovation, leading to more efficient activation of new customers, driving down cost of acquisition.

At Albert, when we cut marketing spend by 30%, we focused on optimizing onboarding flows and referrals, and we found far more than 30% gains in conversion improvements. The outcome: significant reduction in growth spend, increase in profit, and an increase in growth.

2. Hire slowly

The larger the team, the shorter the runway.

If marketing isn't your largest cost center, payroll is. The smaller your team, the easier it is to become and remain profitable. A lean team allows the company to stay profitable, maintain financial flexibility, and deliver results for shareholders.

Large teams somehow became a badge of success for startups (think "We're hiring!" bylines on LinkedIn). But smaller teams almost always deliver better quality, faster. People who enjoy work love working on small teams because they get to focus on actual work, unencumbered with recurring meetings, committee decisions, management layers, 1:1s.

Small teams bring happiness, results, and profit.

3. Minimize launch capital

In 2026, you need almost no money to get your first customers for a software product.

You do not need capital to get your first customers for a software business. If you can write code, you can launch a well designed, polished application in the cloud for no upfront cost. With Claude Code, you can build entire frontend interfaces in days.

This principle applies beyond company launches and extends to product launches as well – lean, well run organizations can launch new software products for no incremental cost.

Operating leverage

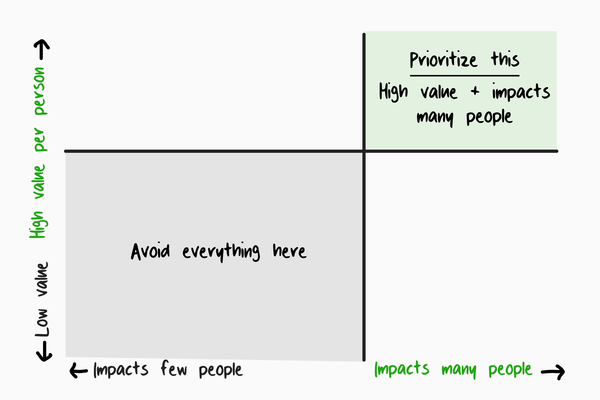

With enough profit, growth accelerates.

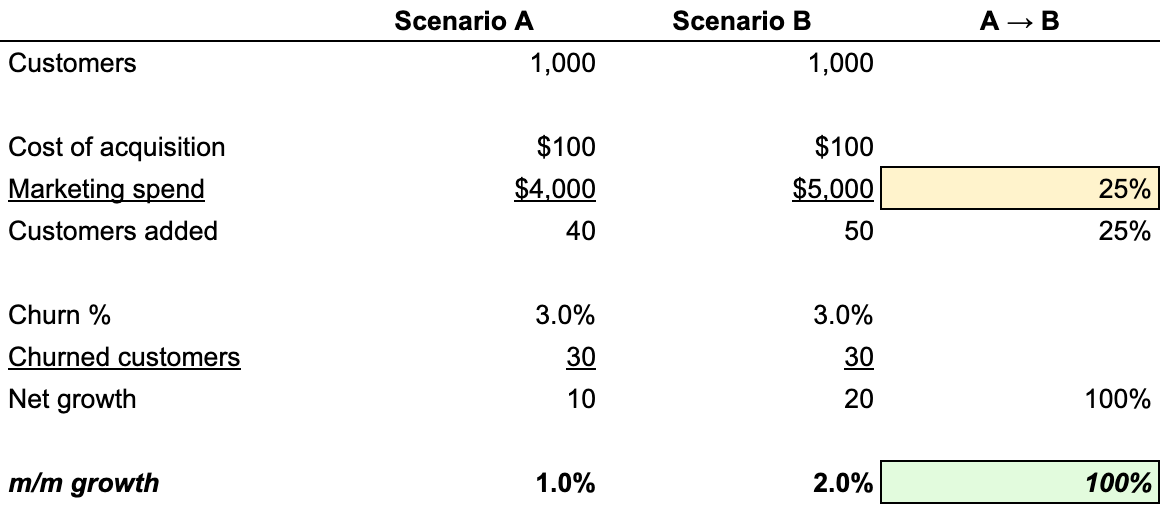

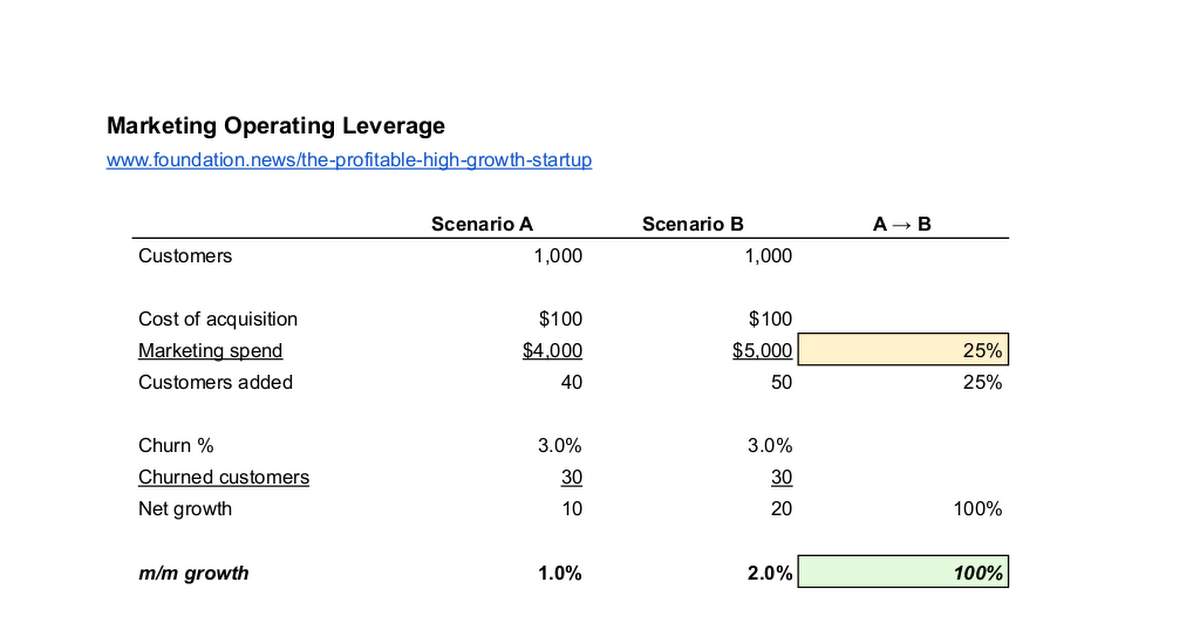

When you reach a certain absolute scale, growth compounds. Consider the example below in which a 25% increase in marketing doubles growth.

Beyond compounding growth at scale, profitable startups have many advantages:

Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.