Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.

The Formula for a Successful Financial Product

A simple formula for building a consumer product: get users, build multiple products, run efficiently.

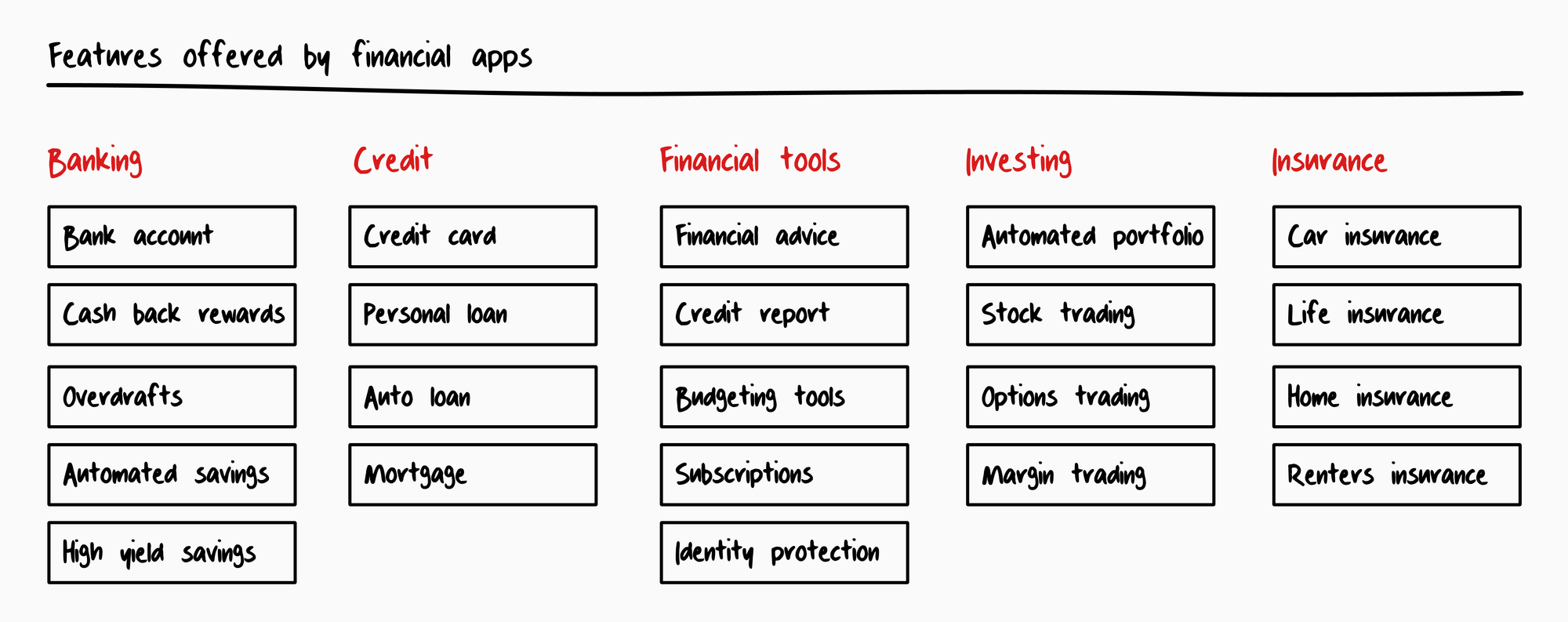

Over the past two decades, financial apps have tried to take market share from large financial institutions. While a handful of new financial companies have reached scale, most have failed, leaving a scrapyard of defunct banking, saving, investing, lending, insurance, discounts, payments, and budgeting apps.

Investors are now largely convinced that building a successful consumer financial product is near impossible. But this is wrong. There is a formula for success that took me nearly a decade of building Albert, the banking app I run, to understand.

The challenge

There are three primary challenges to building a successful consumer financial product:

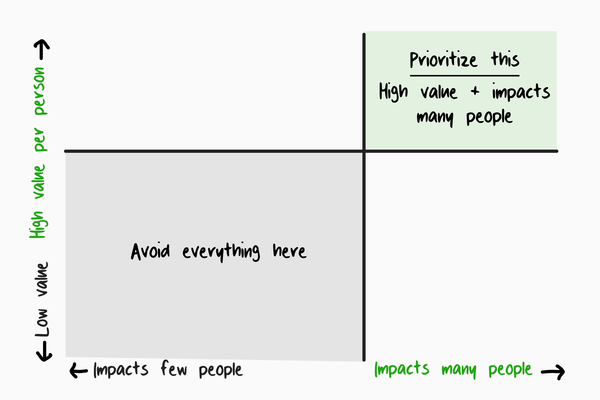

- Prioritization. There are dozens of financial products for a company to choose from. It's tempting to build everything. Unchecked, this leads to lack of focus. Companies must prioritize the right features.

- Time to ship. A new company can build one financial product before running out of money, because each financial product takes at least a year to launch. Pivoting from, say, a bank account to a loan requires more capital and another year of work. Again, companies must prioritize the right features.

- A single product is not enough. In contrast to most software businesses (e.g. accounting software), consumer financial companies need multiple core products to truly succeed. This is true for every large, profitable financial institution in America.

Companies that build the wrong features early usually fail. Financial companies that never make it past a single product don't achieve their full potential.

High yield savings seems like an obvious product to build today because everyone should want to earn 5% on their savings.

At Albert, we focus on customers making less than $100k a year, with a median annual income around $50k (the majority of Americans under the age of 40). On average, financially responsible customers earning $50k/year save $500 a year after retirement contributions. 5% of $500 saved is $25. 3 years of savings is $1,500, earning $75 of interest a year (non-retirement savings generally don't build up for more than several years).

In contrast, offering 2% cash back on our customer's $2,000/month of credit or debit card spend is $480 a year in savings. A great cash back program can offer more than 5x the value of a high yield savings account!

Of course, this doesn't mean that high yield savings accounts shouldn't be built for most Americans. $75 is valuable. It only means that a startup serving the broad American consumer should build other things that offer more value first.

Three steps to success

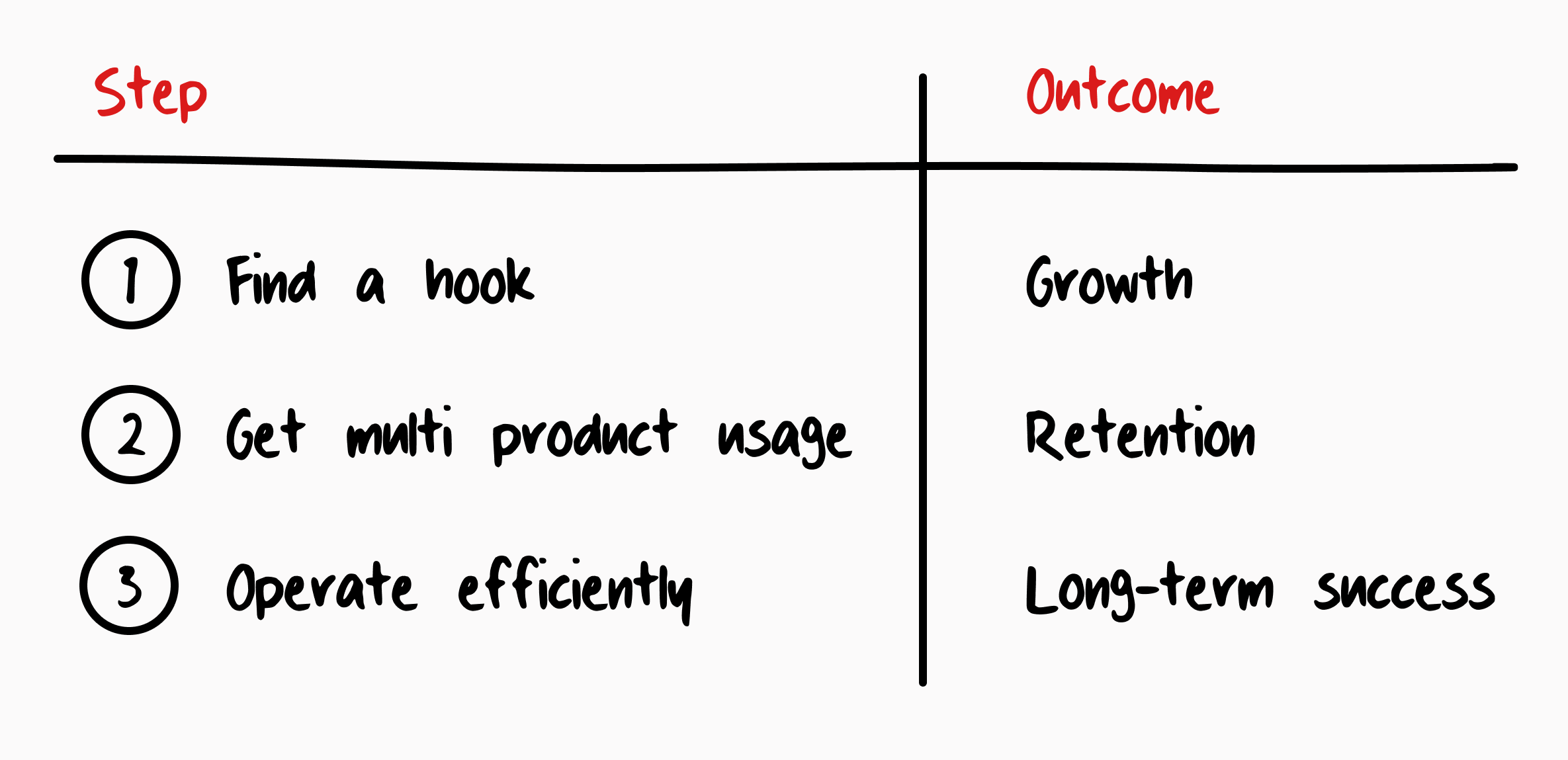

There's a simple formula for building a successful consumer financial product.

With the right design and engineering talent, operational skill, and focused leadership, any financial company can succeed by following three steps:

- Find a product hook

- Get customers to use multiple financial products

- Operate efficiently

1. A product hook

The first step to building any successful product—financial or not—is finding something that gets customers excited enough to sign up.

Over the past two decades in financial services, the most powerful hooks have been commission-free trading, speculating on crypto, peer-to-peer payments, access to credit, budgeting tools, and free credit score.

Access to credit—like credit cards, personal loans, auto loans, and mortgages—has been an effective customer acquisition hook for over fifty years. Bank of America showed this at national scale in the late 1950s when it shipped the BankAmericard, the first general purpose credit card, to millions of American families.

With a great hook, customers sign up by word of mouth or from inexpensive advertising.

2. Multi-product usage

Once a company acquires customers, it must retain them. Many financial products have weak retention mechanisms.

For example, once a personal loan is paid off, the customer no longer has a relationship with the financial institution. Other products, like meeting with a financial advisor, are not used frequently enough to drive high retention. Some financial products are inherently passive with low engagement, like a savings account. Yet other products are commodities with low switching costs, like a checking account (you used to have to go into a branch to open a bank account, but now you can open one online in 30 seconds).

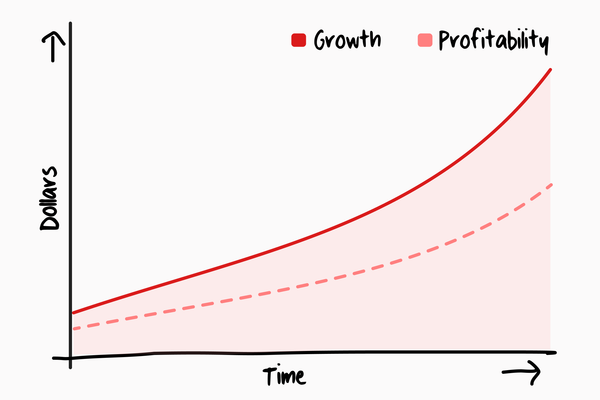

But combining multiple products leads to high retention because there's always something for a customer to do. The breadth of product choice that makes feature prioritization in financial apps hard is also what gives financial apps an unlimited ceiling. In no other industry are there enough products to increase revenue per customer every year for 20 years.

This is the fulcrum of the strategy.

3. Financial efficiency

All good businesses have strong operating metrics: low variable costs, low fixed costs, and positive free cash flow. But most fintech companies, particularly consumer apps, have been built on structurally high variable costs driven by vendor relationships, and they have saddled themselves with high fixed costs and bloated teams.

Financial technology products should strive to look like software businesses: 70% gross margin, less than 30% of revenue spent on fixed costs, and positive free cash flow. I recently wrote about how we think about financial efficiency at Albert.

The one thing

When I look at a successful business, I ask myself, what's the one thing the team understands better than anyone else?

Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.