Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.

Profit Starts With Product

Fast growing, profitable companies have one thing in common: a much better product than the competition.

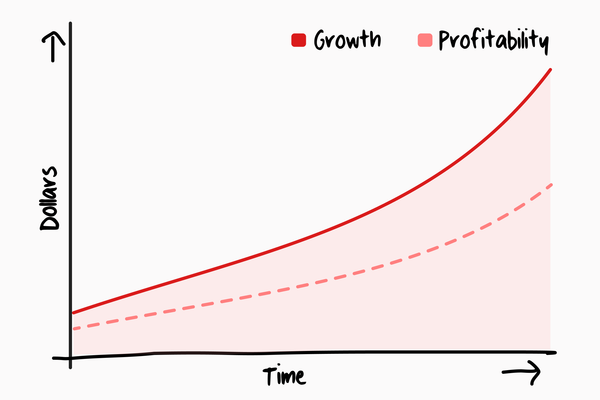

In early 2022, after an unsuccessful fundraise for Albert, the company I run, I sent a letter to leadership about changing course. We would attempt to steer towards profitability while maintaining growth.

As a venture capital backed business that had raised $200 million during a period of high valuations, profit was not part of company DNA. We burned cash because the core business was not healthy: variable costs near 50% of revenue, fixed costs (servers, people, office space, etc.) over 50% of revenue, and marketing dollars repaid in two years.

Albert had one simple problem: revenue per customer was too low. Full-featured banking, savings, investing, budgeting tools and financial advisors cost money, and cheap capital had subsidized costs until early 2022.

While we charged some customers a subscription for premium features, nearly half of all monthly active users were using the app for free. Conventional wisdom says that if customers won’t pay an optional subscription fee for paywalled features, they won’t pay a subscription fee for an entire app. This proved wrong, and thankfully we understood the fallacy in our assumption before running out of money.

This post is the second in a series of posts on how to transform a fast-growing, money-losing company into a profitable one, without sacrificing growth.

Albert Genius, the origin story

Customers are always willing to pay for a product they love.

Albert launched as a free app in June 2016 to early buzz, with 100,000 signups in months. But one year in, cash was running low, we hadn't figured out how to make money, and investors had temporarily abandoned consumer financial services.

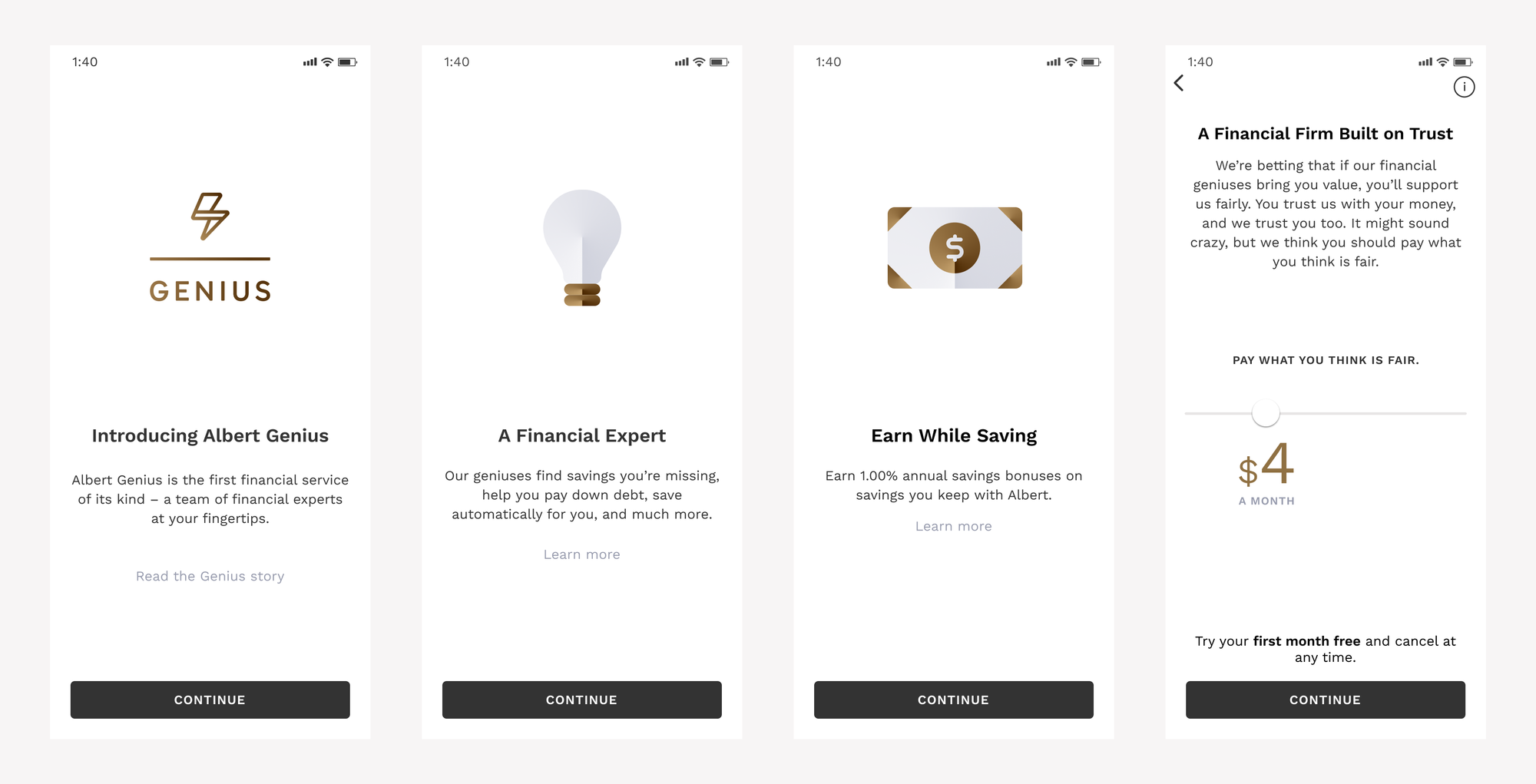

We launched Albert Genius in August 2017. Albert Genius gave users a financial plan, financial advice from human advisors, and extra yield on savings, all built on top of Albert's existing free budgeting and financial management tools. Users could choose to pay whatever they thought fair for the subscription, from $0 to $14 per month. It was one of the first personal financial management apps to charge a recurring fee for premium features.

We released the updated app around noon on a Friday, and the whole company—five of us in a small room at WeWork in downtown L.A.—waited by the bell we programmed to ring each time a subscriber paid for Genius. Within 15 minutes, we disabled the bell because it was ringing non-stop.

Product market fit

Build things people love enough to pay for.

Half of Albert's 50,000 active users chose to pay for the subscription when we launched Genius, selecting $4 per month on average.

The company went from $0 in revenue to $100k in monthly recurring revenue nearly overnight. We learned a lesson we thought we'd never forget: when customers love a product, they will pay for it.

If a customer is unwilling to pay for a product (except social networks), the product almost certainly does not have product market fit. When customers are willing to pay for a product at scale, three things are also true:

- High adoption. A significant fraction of users who sign up become active customers.

- High engagement. Customers engage with the product at least twice a week.

- High retention. For a consumer product, fewer than 2% of active customers churn each month.

If customers won't pay for a product, the product needs improvement. This is a clarifying framework for building product and for building a company: build things people love enough to pay for.

A subscription app

Use A/B tests to test discrete changes to a product at scale.

You cannot A/B test a new product launch. At best, you can build a landing page or a waiting list to see if customers are interested in checking out a new product. Once a product is live and working at scale, though, you can test effectiveness of product changes.

One such test is charging a subscription fee to all customers, which Albert ran in early 2022. We had long believed that customers who chose not to pay a subscription fee for paywalled features would never pay a subscription fee for any part of the app. In a bid to transform Albert's business model by raising revenue per active user, we ran an A/B test that diverted a portion of new signups to an app entirely paywalled by a subscription fee.

Customers loved the product enough that they were overwhelmingly willing to pay. With subscription required, conversion to paid subscription doubled, but surprisingly the percentage of users active two months after joining stayed the same. Previously non-paying customers were now all paying for the app. We relearned the lesson from the summer of 2017: when customers love a product, they will pay for it.

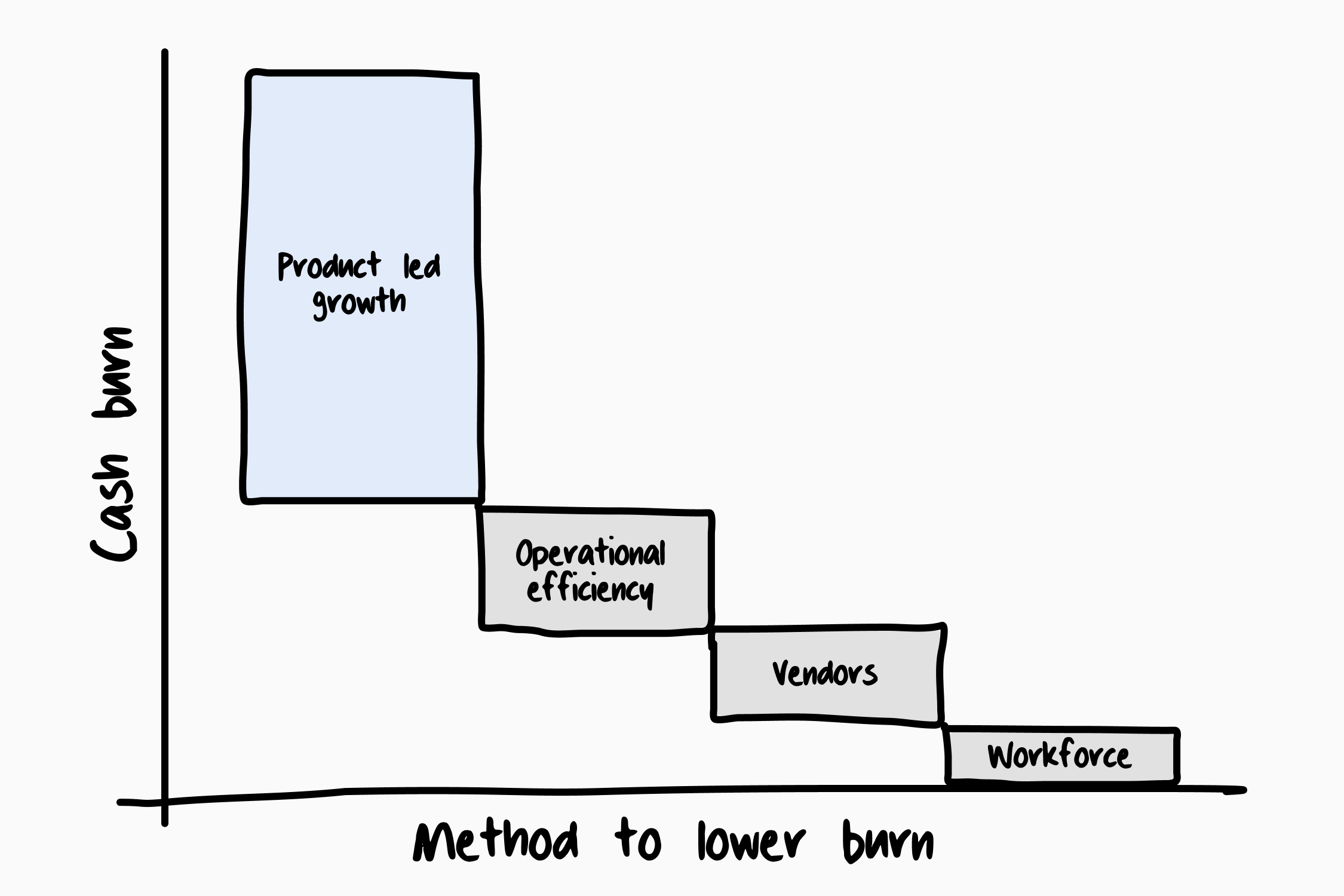

This was the critical first step to profit. We cut cash burn by nearly 50% by reducing marketing, but subscriber and revenue growth did not decline because conversion to subscription had doubled.

Running an experiment you can trust

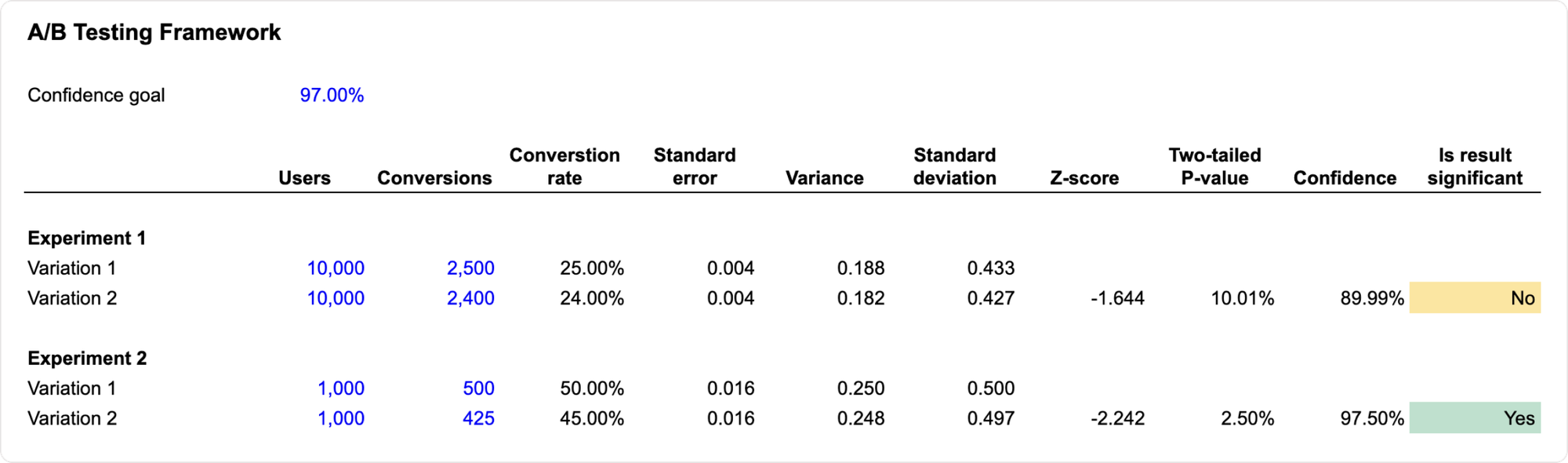

See the A/B testing framework template above for an example of two tests. In the first test, despite 20k users and nearly 5k conversions, we only have 90% confidence that variation 1 is better than variation 2. Run the experiment nine more times, and you'll get a different result about once.

Can you stake a decision as big as charging all customers on an experiment that could be wrong one out of ten times? Download the A/B testing framework to see if you can trust your data. We'll cover this in more detail in a subsequent post.

Growth by experiment

Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.