Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.

Money In > Money Out

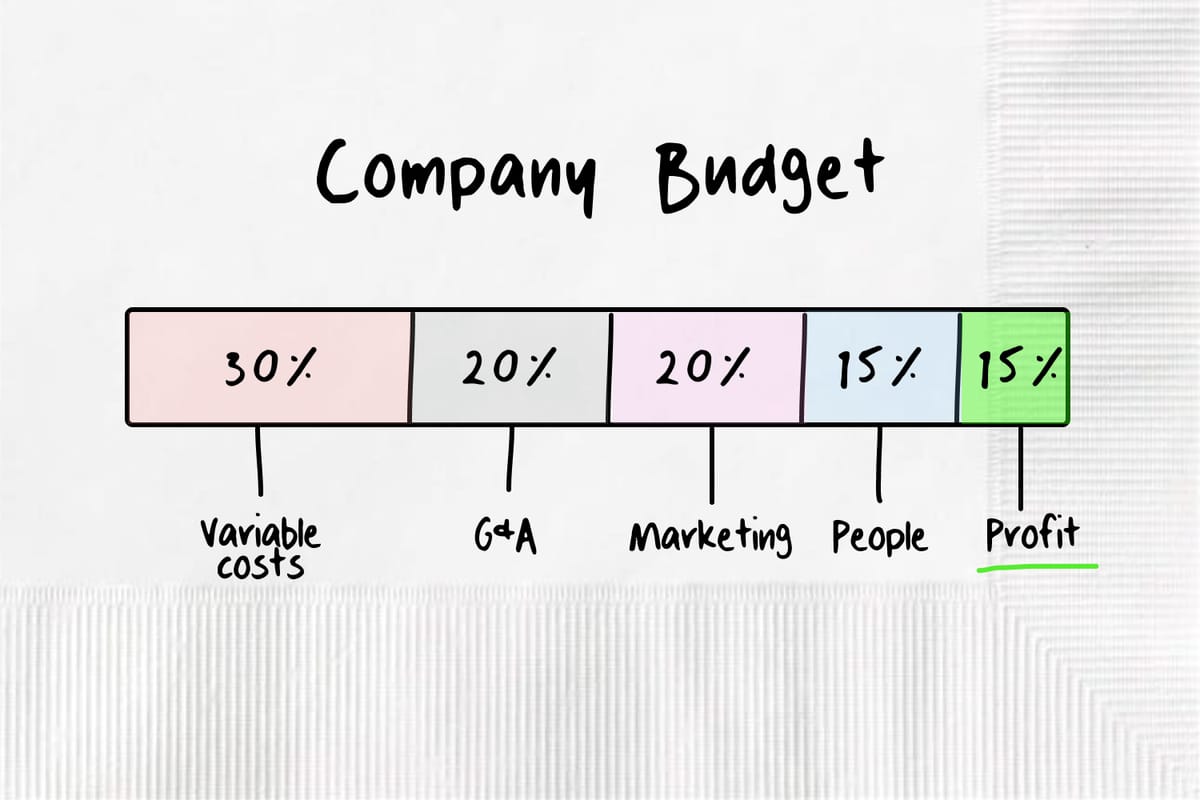

Simplify your budget to fit on a single sheet of paper.

I've written about Albert's path from cash burn to profit a few times. Many things contributed to the business's transformation, but none more than simplifying the budget to fit on one sheet of paper.

Charlie Munger, Warren Buffett's long time investing partner, quipped, "I think that, every time you saw the word EBITDA, you should substitute the word bullshit earnings." Like many companies did when capital was cheap, we confused ourselves with second-order metrics: the lifetime value of our customer was high so it was okay to lose money today; we're spending 50% of revenue on people because we're investing in the future; our adjusted EBITDA margin isn't terrible; and so on. We burned a lot of money believing this story.

When we turned focus to profit, we leaned into our best skill as product builders: simplifying things. We built a budget—covering our entire complex business—to fit on a single 100 row spreadsheet.

Jargon

Charlie Munger's gift was elegantly simplifying complicated topics. To understand companies, he started with the simplest question: how much profit a company earns. For a company to survive without an investor's generosity, only one thing matters: actual cash profit.

In your personal budget, you know things are good when cash goes up, and that you have a problem when cash goes down. Businesses benefit from this simple thinking too.

To free ourselves from jargon at Albert, we now run core business strategy from our single page budget.

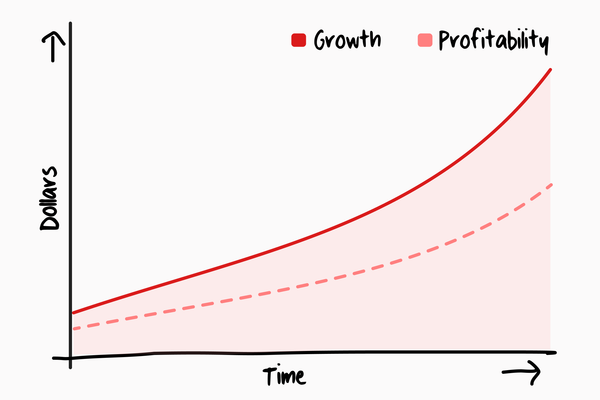

Is a business opportunity big enough to raise venture capital or should it be run profitably? These are not mutually exclusive.

We have raised over $200 million at Albert, burning capital through the zero interest rate period (ZIRP). And we have also run Albert profitably over the past two years. We owe much success to venture capital. But we could have been more efficient with capital.

Most venture capital backed software businesses should aim for profitability by $25 million of revenue per year. During ZIRP, we waited until $100 million of annual revenue to focus on profit. This cost the company expensive dilution.

Building a budget

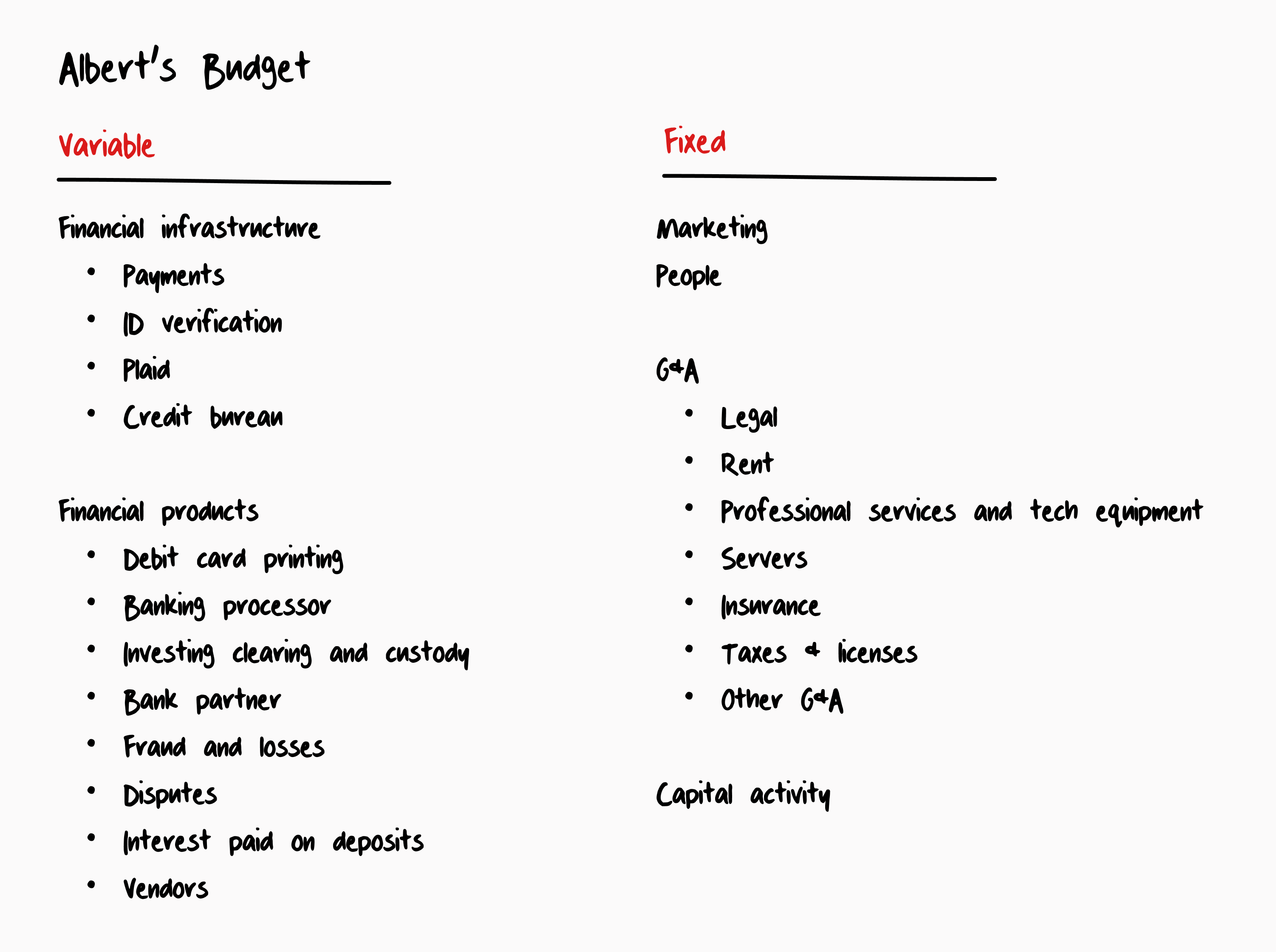

Companies should build a budget like you would a personal budget: revenue at the top, and expenses by category below that. Here's Albert's actual budget:

The Cash Flow Session

With a simple budget, it's easy to understand where money is going.

Two years ago, we started a quarterly leadership meeting at Albert called the "Cash Flow Session." Each quarter, the leadership team, who has full access to company financials, brainstorms ways to increase cash flow.

Each leader suggests initiatives in their domain. For example, the head of operations suggested ways to lower fraud and losses. The COO came up with vendor expenses to renegotiate. The head of people was responsible for a reduction in workforce. The head of product thought of ways to print fewer debit cards without lowering usage. Variable expenses are prioritized over fixed costs.

When Albert was generating $10 million of revenue per month, every Cash Flow Session generated at least $300k/month in savings. 3% of revenue saved for an afternoon discussing the uncomfortable and tedious! Sitting in a room together with a white board, thinking of ways to save money, always made money.

We relearned a lesson Munger preached for nearly a century: first, focus on making money.

Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.