Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.

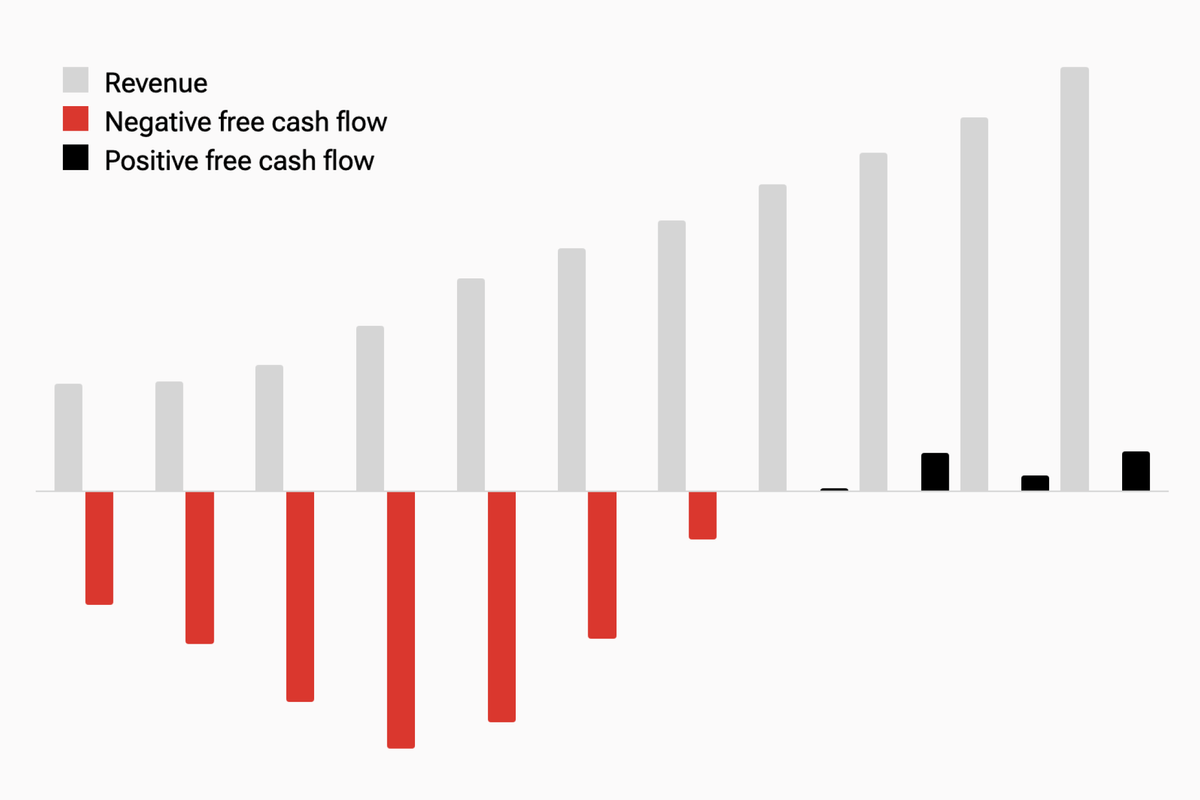

From High Cash Burn to Profit: How to Transform a Company

When venture capital dried up in early 2022, companies began charting a new path. The outcome: profit.

In January 2022, I tried to raise money for Albert, the company I run. The business was doing well, generating $75 million of annualized run-rate revenue.

I had raised $200 million over the company's first six years, but this time was different. Albert was burning millions of dollars a month, and investors had suddenly lost appetite for funding an operating loss. Growth-at-all-costs, tech's calling for nearly a decade, was about to fall out of favor, but most companies had no idea because they were not actively fundraising.

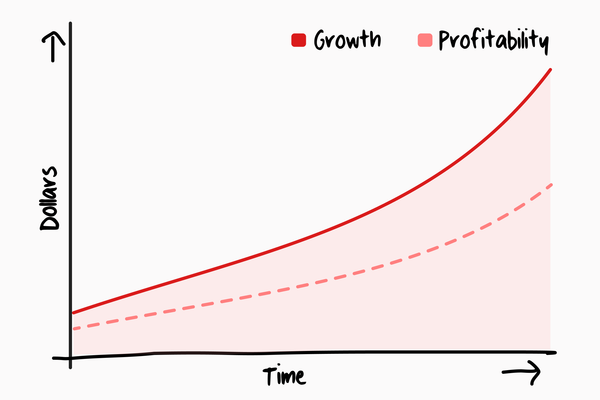

This post is the first in a series of posts on how to transform a fast-growing, money-losing company into a profitable one, without sacrificing growth.

The macro environment

Here's what I wrote in early 2022 to Albert's leadership team about the environment:

I have spent the last several months meeting with investors, and the market is undergoing a substantial shift. The appetite for investing in unprofitable businesses is gone, and we must adapt.

The macroeconomic environment is changing. Inflation has spiked because the Fed printed a lot of money. The Fed must now raise interest rates to curb spending. This has cooled public and private investment, and it will also likely lead to a recession. In times of uncertainty, investors look for safety. As a result, most high growth public stocks are down 75%+ from their highs, and mid/late stage private investment, starting at Series B, is paused.

The past 15 years of consumer fintech can be divided into 3 phases:

1. Users: from 2008-2015, companies like Mint gained millions of users. This was a watershed moment, because it proved mass adoption of new tech-driven financial products.

2. Monetization: starting in 2015, investors looked past eyeballs to measure success and shifted focus to revenue. From 2015-2021, consumer fintech figured out revenue: subscription, interchange fees, referral fees, payment for order flow, money movement fees, and more. Albert has been one of the successful fintech companies in both the user and monetization phases.

3. Profitability: investors are now looking for the subset of these businesses which will become profitable. This simply means that revenue > all spending, no different from our personal budgets. Today, most consumer fintech companies are not profitable: Robinhood, Affirm, Sofi, Chime, NuBank, Varo, Current, Dave, and Albert.

If you can earn 5% risk free by lending to the U.S. government, and public companies are trading at historically cheap multiples, why invest in an illiquid, late stage private company that could go bankrupt because it's losing money, only to earn 15-20%? This quickly becomes a self perpetuating cycle: less private investment drives more private investors away because there is no liquidity. And tech companies, which for decades lost money to reach scale, suddenly find themselves without capital to survive.

Changing course

Here's the rest of the letter I sent to management, dated early 2022:

• Unit economics: make sure that our unit economics work and stay that way – this means that the marketing dollars we spend should come back in under a year. The shorter the payback period, the less capital we need to grow.

• Profitability: get Albert to profitability. Once we’re profitable, raising money becomes much easier, because we don’t actually need the money.

Both of these require tradeoffs: we’ve pulled back the least efficient marketing spend and will continue to do so. Despite lowering our marketing budget by nearly 50%, because of our singular focus on growth over the past 45 days, May will be the company’s strongest growth month ever, with signs of acceleration. We will focus more on cutting operational costs, and we will be deliberate about the size of our workforce.

• Monthly cash burn: we burned $X million (redacted) in February, 5% less in March, and are track for 30% less in April, 50% less in May and 60% less in June. The goal is to get to $0 of burn as soon as possible.

• Growth: our focus on growth initiatives (referrals, web flow, onboarding flow) is driving big growth numbers in May despite a 50% reduction in spending. This is remarkable because it means profit without sacrificing growth.

• Operational costs: we have renegotiated with dozens of vendors, have cut redundancies, and are starting to see savings. This is a mindset shift, and our leadership team is well-suited for this exercise.

Thus far, we’re meeting the moment, but there is a lot of hard work left to do to get to profitability.

• We’ll continue focusing on growing revenue and lowering costs, with the goal of being profitable by the end of the year. Times of uncertainty demand unwavering conviction, and we’re going to take the necessary steps to reach profitability. This will ensure that all of the hard work we’ve invested in Albert will pay off.

• I’ll reach out to each of you with the company’s budget, and we’ll collectively decide how to make that budget work. As always, I’ll maintain complete transparency, sharing the company’s entire budget down to the line item, so you’ll be able to draw conclusions on your own.

I’ve never been more excited about what we can accomplish, but it’s going to take very hard work, innovation, persistence and determination – the essence of being a startup.

Let's build.

Albert became profitable by the end of 2022, a goal that seemed impossible at the beginning of that year. Once the company started meaningfully lowering cash burn, financial independence became a rallying cry for the company. The speed from peak cash burn to profitability surprised everyone, but our story is not unique. Companies that seriously pursue profitability will achieve progress faster than they can imagine at the start of their journeys.

Changing DNA

If a company has been burning money for years, it's in the company's DNA.

To turn a profit, a money-losing company must change the way it naturally operates. Below are concrete guidelines to changing a company's DNA:

- Transparency. The CEO must share the company's financial model, down to the line item, with the entire management team. You've hired smart people. They need to draw conclusions on their own to buy into a new strategy.

- Honest assessment of great. A great consumer business has variable costs less than 30%, grows more than 50% a year, and generates free cash flow of at least 10% of revenue. A great b2b business has even lower variable costs, and net revenue retention above 125%. Strive only for great metrics. This may mean completely changing the company's business model, like charging a subscription fee.

- Savings are at least as good as revenue. A dollar saved is a dollar earned, the saying goes. In fact, savings are 100% profit margin; revenue is not. Prioritize projects that save money until the company is no longer burning cash or there are no more meaningful savings. For example, you may be overusing a vendor that is charging for dormant users. Fix that before trying to increase revenue.

- Only employ people you can afford. Perhaps the biggest change in outlook is only employing the people you can afford. For example, at $100M of annual revenue, it is reasonable to spend 25% of revenue on people. This translates to about 150 employees for a tech company. Do not benchmark against the past five years of hiring trends; cheap capital drove bloated hiring. Letting go of any employee sucks. But it sucks a lot more to run out of money and let everyone go.

- Spend on things that matter. Every expense should return money, increase productivity, or bring joy. If an expense does not have measurable monetary return, increase productivity, or bring joy, it is wasteful. Be careful with recurring expenses: they are at least twelve times more expensive than one-time expenses. Here's a deep dive on reducing waste.

- Get in the weeds. Reducing expenses and increasing revenue are a collection of many small and medium sized tactical improvements. The entire leadership team must be in the weeds. You can't strategize your way to profitability.

When you do reach profitability, there is a sense of incredible relief from the entire company. Not having money is one of the great causes of anxiety for people around the world. Companies are no different.

Does raising money still make sense?

Yes, for many types of businesses. But raising too much money before reaching sustainable profit only works when investors are willing to finance a large operating loss. This was true during much of the zero-interest-rate period, but it ended when interest rates rose.

Today, once a company has raised its first $25-50 million (depending on industry and capital needs of the type of business), there are only three acceptable reasons to raise more money before turning a profit:

- R&D: funding a project that a company cannot afford on its own. For example, hardware and biotech need capital to make new discoveries.

- Fund an acquisition: acquisitions can be financed by company stock, an equity investment or debt. All make sense in different situations and can also be used together.

- Market defining company: in rare situations, a company has the chance to change the behavior of tens of millions of people. Uber and Airbnb had this opportunity. This type of company can justify investing money in growing market share as fast as possible, profitability notwithstanding.

How profitable?

Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.