Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.

3 Tools to Stop Startup Fraud and Waste

Three financial hygiene tools can eliminate fraud and dramatically reduce waste at any company.

A few years ago, I hired an executive coach to help run a strategy day for the leadership team at Albert, the company I run. During one of the sessions, he told me that the CEO should not worry about line items in G&A expenses. Delegate this, he said. Perhaps counterintuitively, his approach leads to inefficiency and waste.

Investors are realizing that there is fraud and waste in their portfolios. Some of it has been exposed, like FTX. More of it will be exposed soon. For example, Softbank is suing the CEO of IRL, a pandemic-era social app, claiming that 95% of its users were fake. While big cases like FTX get headlines, they are also rare. Most cases are more subtle: a company was run legally, but poorly, and could have thrived with financial discipline.

Fraud and waste don't have to exist at any company though. They can be removed with simple tools.

Three fundamental tools

There are three tools any organization can use to keep a tight grip on its money:

- Weekly finance approval

- Monthly cash reconciliation

- Quarterly recurring expense review

The basic principle behind each of these is adding visibility: it's much easier for someone to waste money or commit fraud alone than it is for someone to convince multiple coworkers to do so.

Below are templates and processes for each of these tools. All of these tools can be used asynchronously, and none require a recurring meeting. If you're serious about building a profitable, scalable organization, all three are mandatory.

1. Weekly finance approval

What a company spends money on closely tracks the company's priorities.

At Albert, every expense is requested by someone on the leadership team, and both the CFO and CEO approve every expense above a certain threshold. To manage this, we run an asynchronous, written weekly approval process—the Weekly Finance Document. It takes only 15 minutes every Tuesday to review expenses.

It's a four step process:

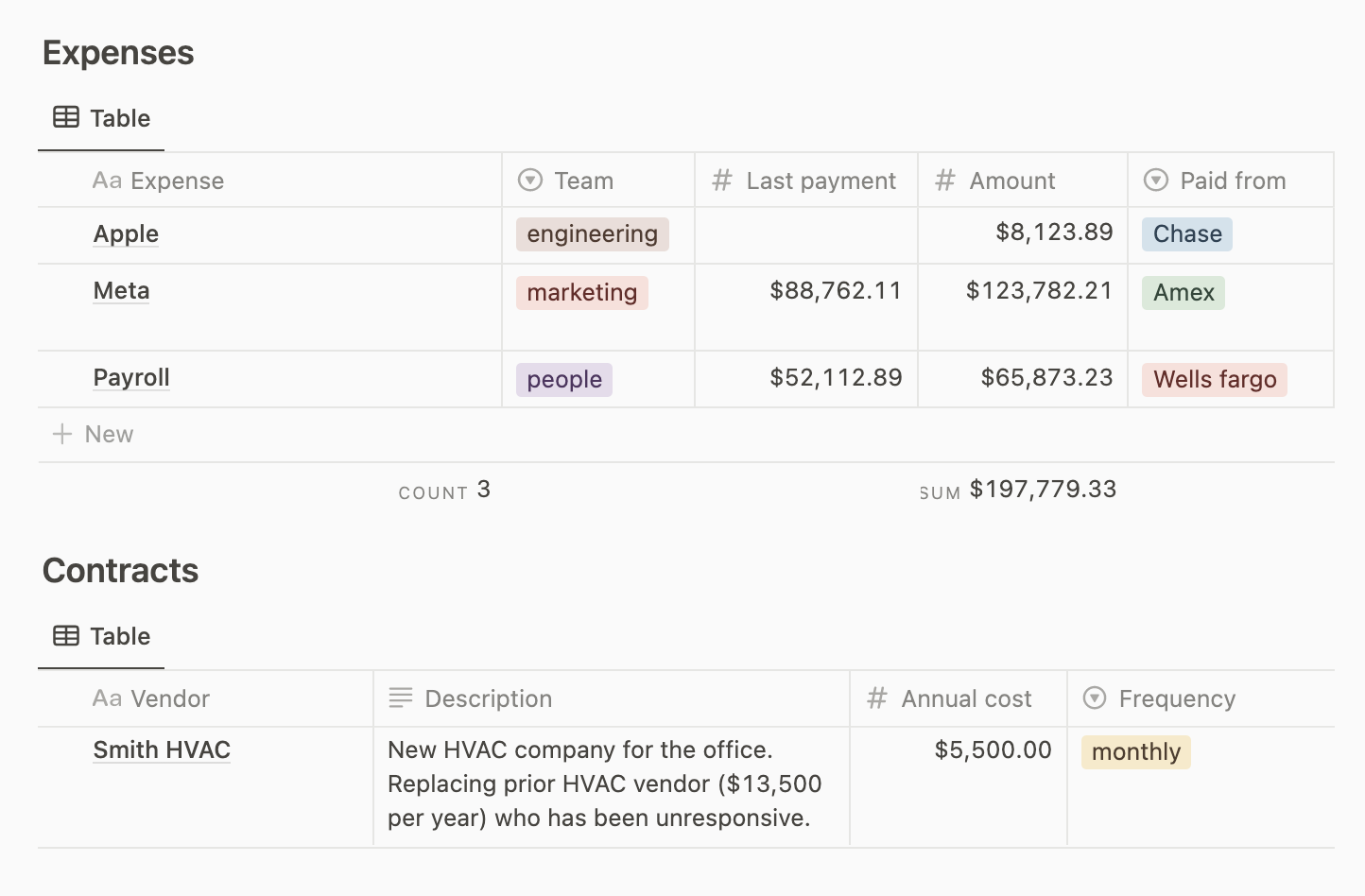

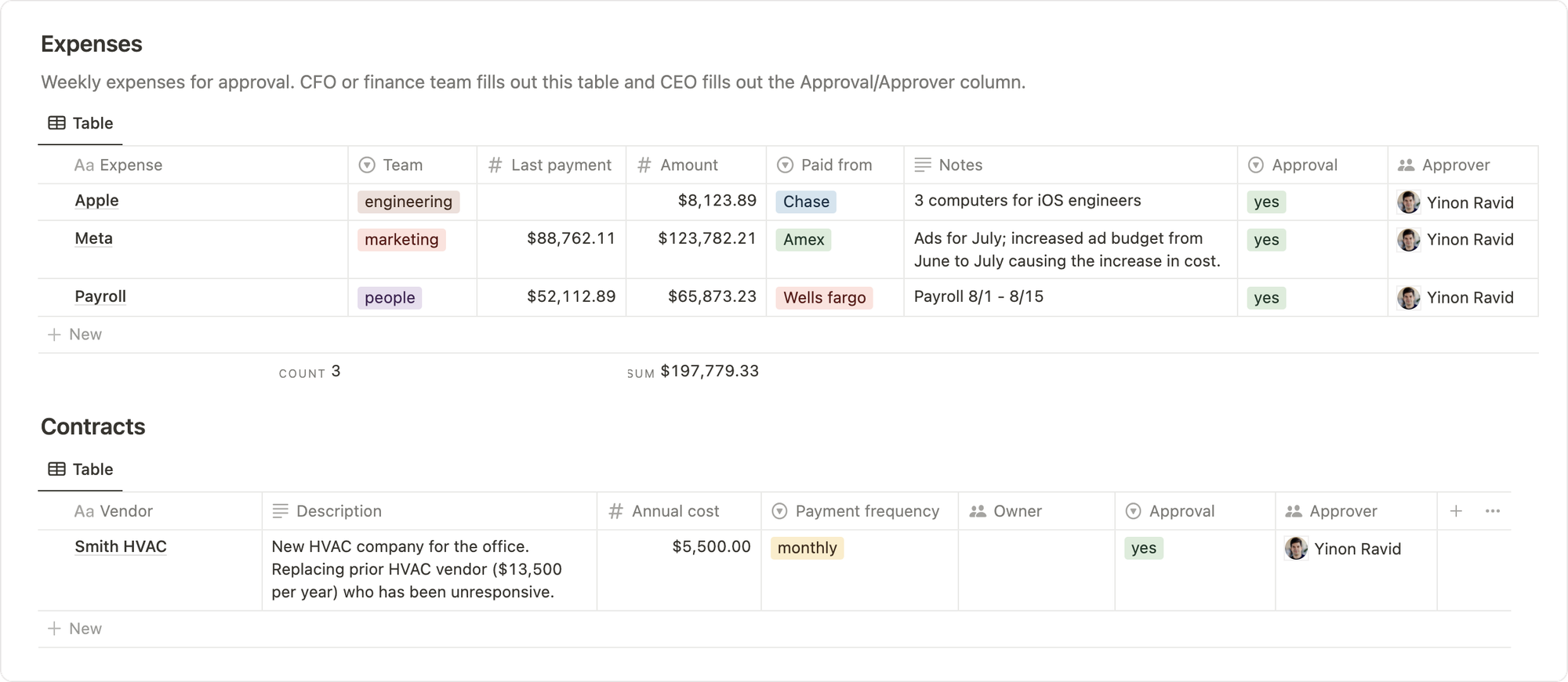

- During the week, leaders submit expenses and contracts above a certain threshold (see below on picking a threshold) for approval by the CFO.

- On Monday afternoon, the CFO assembles approved expense requests, other expected expenses (e.g. payroll, contract renewals, vendor payments, etc.), and other important spending metrics into the Weekly Finance Document.

- The CEO reviews the document on Tuesday and places expenses in three states: "yes," "no," and "action required." Action required means that live follow up is needed before approval or rejection. In practice, "no" and "action required" are rarely used, because the CFO has already approved all expenses and this weekly process quickly aligns the team. The CEO also reviews the detailed spending metrics every week.

- All rejections are discussed live, which limits future rejections. Rejections can also be overturned with clarification.

Revenue threshold | Expenses to review |

$0-1M | Review all expenses |

$1-10M | Review expenses > $1,000 |

$10-100M | Review expenses > $2,000 |

$100M+ | Review expenses > $5,000 |

The process is enlightening: we've found renewals for services not used, vendors overcharging, a tax payment that was too high, and more. Innocuous mistakes are quickly addressed before becoming toxic. More than anything, this weekly process ensures that the entire leadership team—and particularly the CFO and CEO—are always aligned. What a company spends money on closely tracks the company's priorities.

A misunderstood concept in managing expenses is what actually contributes to structural unprofitability: it's not meals, an outing for the team, swag, travel, or nice furniture for the office; these are comparatively small, non-recurring, and improve productivity and culture. It's large, recurring, wasteful things like over hiring; overcharging by vendors; contracts that have not been renegotiated in years; unused recurring services; low quality products no one uses; legal and consulting fees.

The Weekly Finance Document is very effective at highlighting waste. With a repeatable and fast weekly approval process, organizations avoid excess, stop bad actors, and focus on what matters.

Weekly Finance Document

2. Monthly cash reconciliation

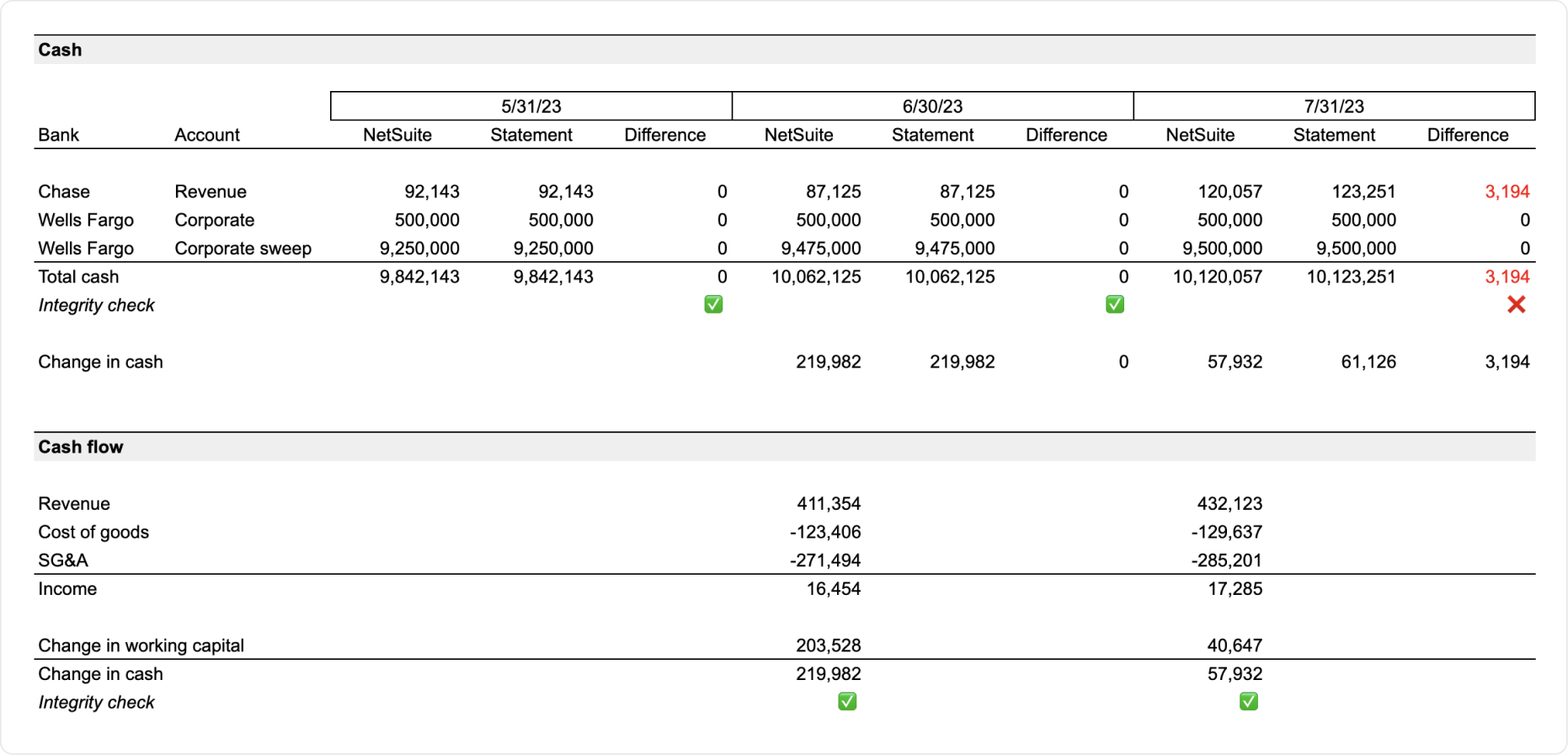

Cash reported in financials must match cash in the bank every month.

Quarterly financial statements and an annual audit are necessary, but they are not effective at catching mistakes and waste in real-time. Companies and investors need to know that the cash reported in monthly financials matches cash in the bank at the end of the month—to the dollar. Further, they need to know that change in cash in the bank = revenue - expenses + change in working capital.

Every month, a company should show that the sum of cash on the company's bank statements less the sum of cash on the company's bank statements last month is equal to the change in cash in financials. This is a simple, powerful exercise that can be done with the Cash Reconciliation Spreadsheet and by downloading bank account statements. Unless the entire finance team is collaborating on doctoring bank statements, this process proves with certainty that monthly financial metrics are accurate.

The Cash Reconciliation Spreadsheet should be part of every private company's monthly financials.

Cash Reconciliation Spreadsheet

3. Quarterly recurring expenses review

Recurring expenses are at least twelve times more expensive than one-time expenses.

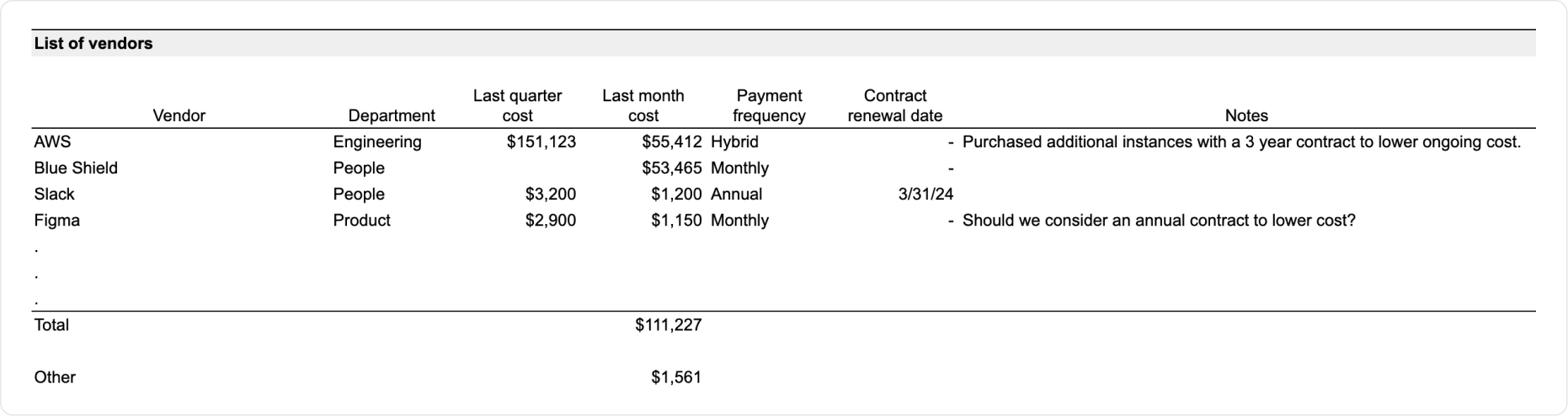

It's common for companies to pay for dozens of recurring services. Cloud hosting, a vendor that is a cost of revenue, a payroll provider, productivity software, and more. These services are critical to running most businesses. But over time, services become redundant, go unused, grow too fast, and charge too much.

To keep recurring spending in check, add visibility. Every quarter, use the Recurring Expenses Spreadsheet to review all recurring expenses above $1,000 (if the company is small, lower the threshold to $0). Look for several things:

- Redundant services

- Unused services

- Unrecognized expenses

- Recurring expenses growing too quickly because of usage

- Contracts that have not been renegotiated in over a year

At least one of these things will exist every quarter, and each must be addressed quickly. Evaluate every recurring expense with two questions: (i) do we need this expense? and (ii) how do we lower it?

Almost every recurring expense can be lowered with a combination of contract negotiation and tuning usage. Recurring expenses are expensive; limit them as much as possible.

Recurring Expenses SpreadsheetWhat should a company spend money on?

Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.